How to a 800 credit score get it and keep it. #2

Lets start simply They say that your payment history is 35% of your score .

That is only true if you have a good score if you have unpaid accounts or collection because you did not pay as promised, then it will stop you 100% from achieving a 800 score.

#1 You have got to get it in your head that a debt is a promise, that you made and you have got to keep your promise, there is no escape ever.

You do not want an escape.

This keeping your promises, affects your entire life, your state of being and your identification of your self worth.

(He who promises Runs in debt)

Do not listen to any one, telling you it will be gone in 7 years.

Bull shit, it will only go away if you settle the debt and then, it will go away 7 years later.

If you do not settle the debt, they will resale your debt time after time and chase you and screw your life and peace of mind and credit forever.

Just stop any thought of escaping your responsibility. You have got to keep your word job #1.

A debt is a promise you have made, and every promise is a debt of some type. Your un kept promises will bleed you dry.

Your word, your signature, your handshake, your promise, may be cosmetically overlooked by your wife your kids your friends, your self.

But the financial world will not overlook it.

There is only one way, You must Keep your promise.

If you are ready to accept your responsibility then follow along with me.

If you are still looking for a escape, I can not help you do not waste your time here.

First lets get a clear hands on understanding of the financial promises you have made.

Cancel all paperless billing, reinstate the actual paper bills that come in the mail box.

(Life is only as real as you are) Life is better lived hands on.

No more abstract financial anything, you will physically hold your finical life in your hands.

Feel it, become one with it. You will learn your debts and creditors so well that you can see them in your sleep feel them in your gut, you will learn they are your best friends. you will see your finances as a clear road map to financial freedom.

We can easily research for any and all information we need any time we need it.

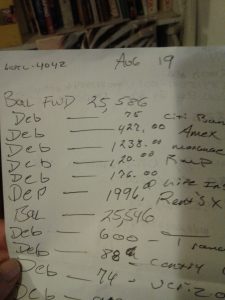

Now we are going to Create a set of hand written ledgers title them accounts payable and payment account or whatever makes sense to you. Pieces of paper that will be written by your hand and held in your hand.

Now collect a full set of your bills everything you owe, get them in your hand.

On the first ledger list every bill you have. list the bills by date due. 1st – 15th then 15th thru 30th include all of your bills.

Now get another piece of paper and create a ledger for the account you use to pay your debts. If you have more than one then consolidate to one, understand that (simplicity is power) and you need that power to achieve what we are after.

Now get a known current balance put it at the top as first entry Balance forward. Now run the ledger as deposit and debit each entry will have notation of check#, if it was a check or a notation and recite for cash withdrawals, or deposits and a notation for each debit or electronic payment who it was paid to and any other important info.

After each session of debit’s or deposit to the account do the math, record your current balance with a notation of date.

Note for each deposit where it was derived from. Carry a minimum of 1000$ buffer in the payment account. When the ledger shows a 0.00 bal. you have $1000. In the account.

On the accounts payable ledger your goal is to pay 15+ days in advance so the set of bills due 15th – 30th current month are paid on the 1st – 15th. bills due 1st – 15th following month are payed 15th – 30th current month. I sit down at my desk twice a month to pay bills, on the 1st and 15th. Every payment that is made will have a notation of check # or conformation #

now these ledgers folded in half, will create a pocket to hold all the paper bills. The Paid bills out of there envelope, and unpaid bills turned up in the envelope also recites, check copy’s bank statements Etc. I use a large paper clasp to keep it all together. At the end of the month you have a sweet little package of records for that months financial activity.

Create new ledgers using last months ledgers updated for the next month. Put the last months completed ledger package in storage for any time referral and tax time.

Now just do this.

You have created a hands on relationship with your financial obligations. And a way of understanding and paying your bills on time every time.

Just do this one thing for now.

Pay on time every time.

Next time video #3 we will work on prioritizing witch bills we pay down and why & increasing the credit limits and why.

If you will start paying your bills on time every time you are on your way to a 800 score.

Keep your ledgers up to date so you know exactly where you are at all times. Fondle your bills and ledger get very personal with them.

Just do this one thing get rely good at it.

Be happy you are on your way.

See you next time.

Don’t forget click, the thumbs up, subscribe and click the bell.

See associated video Click this link

I remeber having an 800 score, it was fantastic. I was able to get better than the best rates being advertised. Working diligently on getting my score back up there. It’s not as hard as one might think, even if you have bad debt or broken a promise for a period of time you can always track it down and get it settled either in full or half. Just make sure you keep a receipt of payment, them third party creditors are sneaky and tend to sale your account multiple times. Getting a copy of that receipt to the Credit Bureaus and possibly copies to other creditors makes it much easier..

You know keep the records collection hard ball tactics they don’t play fair better if they never get your name. Thanks for your support.